17 April 2017

New company car tax explained

For many years, successive Governments have seen the taxation of company cars as not only a means of raising revenue, but as a way of changing the behaviour of employers and employees in the way that they select and operate vehicles.

In particular, there has been an influence on fuel types and CO2 emission levels. As the original objectives for these have broadly been met, the emphasis is inevitably shifting towards new goals. Following every one of these new legislative initiatives, there is a period of time required for a full understanding of the impact to be made by fleet operators and for company car policies to be amended if necessary.

Thankfully, help is at hand for Activa customers to deal with such changes as we see it as our responsibility to not just provide an awareness of the issues, but to spell out the implications and to suggest ways and means of moving forward.

In the recent budget, a major new factor was introduced into the employee’s tax situation in certain circumstances and the purpose of this communication is to give an overview of this new position.

What has changed?

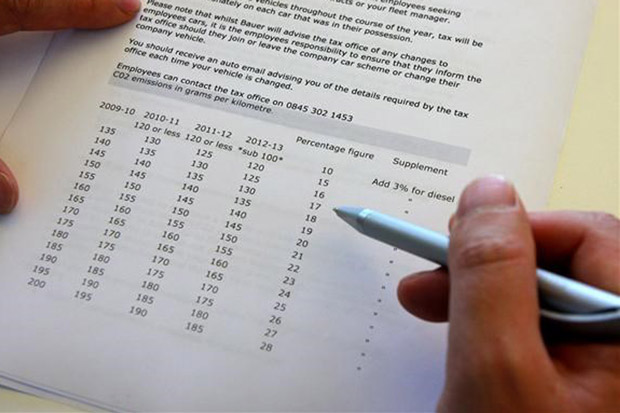

Where an employee does not have a cash option in lieu of a company car, nothing has changed. The taxable value of the Benefit In Kind (BIK) continues to be the product of the P11D value of the car multiplied by the Car Benefit Charge percentage (based on CO2 emissions).

It is where a cash allowance option in lieu of a company car exists that things have changed. The previous situation was that the BIK Tax would be paid if the car was chosen, with Income Tax being payable on the cash concerned if the cash allowance option was selected.

From here on an employee who takes the cash option will continue to pay Income Tax on the cash allowance, but if they choose the company car they will pay tax on whichever is the greater; the BIK tax on the car or the Income Tax on the cash allowance.

Who does it affect and from when?

• It affects any employee given the choice of a company car or a cash allowance, or who takes a car on a salary sacrifice arrangement.

• The changes come into effect for all employees entering into new arrangements on or after 6th April 2017.

So what does it mean in reality?

Here’s a typical scenario for the year 2017/2018:

• A standard rate tax-paying employee is offered a choice of either a company car or a cash allowance of £5,000.

• The car offered is a Mercedes-Benz A180d SE.

• The P11D value of the car is £23,140.

• The CO2 rating of the car is 89 g/km.

• The car benefit charge percentage is 20%.

• The taxable value of the car’s BIK is £23,140 x 20% = £4,628.

• The BIK tax payable on the car is £4,628 x 20% ÷ 12 = £77.13 per month.

• The Income Tax payable on the cash allowance is £5,000 x 20% ÷ 12 = £83.33 per month.

If the employee takes the company car, they’ll be taxed on the higher of either the BIK tax or the Income Tax. In this case it’s the Income Tax at £83.33 – which represents an increased tax cost of £6.20 per month for the use of the car.

But that’s not the whole story. National Insurance Contributions (NIC) are payable on the cash alternative, but not on the company car. In this example the employee would pay 12% NIC on the cash allowance at £100 per month. When this and the Income Tax on the allowance are deducted, the employee is left with £233.33 per month to spend.

The reality is that it simply would not be possible for the employee to cover the total costs of owning and running the same car out of their net cash allowance and this highlights the need to focus on the true value of the company car, rather than on the narrow aspect of the Income Tax differential on the options. The company car driver gets a regularly replaced new vehicle that is fully and professionally maintained and insured and has none of the financial risks and costs of ownership.

However, it should not be assumed that pattern of the above illustration would apply in all situations. A change in the cash allowance, the car selected or the employee’s tax rate would result in a different effect. And this is where we come in – as we can provide a bespoke evaluation using our state-of-the-art financial modelling tools.

What do you do if you think you are affected?

If you are in doubt about your circumstances or are unsure what the best option is for you, give us a call. As explained above, there is no one answer to the ‘Cash or car?’ question and so we’ll carry out a detailed evaluation and provide advice and guidance on an individual basis.